How to use Infostock Equity Reports?

Stock Market Investment is an interesting business for any individual. It is simple to buy and sell stocks of any company listed on a stock exchange like NSE or BSE. The question rises "how to find a good company?" because you are busy in your own job or business and there are many companies in NSE and BSE whose shares are bought and sold everyday in stock market.

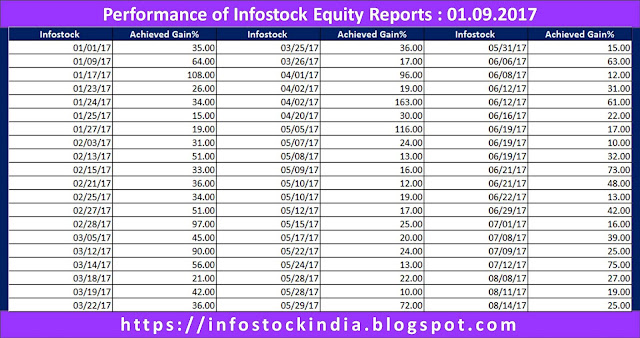

Infostock India can help you to find some of the good stocks from stock market. You just need to follow certain steps:

1) Subscribe Infostock Equity Reports.

2) Check your gmail or visit the blog www.infostockindia.blogspot.com daily after 9 p.m. and before 9 a.m. if the latest equity report is available.

3) Login to blog and read latest report.

4) In case you have fund to invest, take a decision to invest in the stock covered under the latest equity report otherwise just observe the performance of the stock for few days on www.nseindia.com.

5) Always set Stop Loss Price for each stock you buy. For Example if you buy a stock at Rs. 100, you must set a price below Rs. 100 to sell it in case it's price falls down in the stock market. Minimum SLP could be 2% and maximum 10% based on condition of stock market.

6) In case stock price rises up after few days, you can modify your SLP. For Example you buy a stock at Rs. 100 and it reaches 120 Rs. after few days, you can hold it unless it falls down to 2% to 10% from Rs. 120.

7) In stock market you can make good profit if you are ready to hold a good stock for long period. For example Stock Price of KRBL Limited was Rs. 24.00 on 13.05.2013 and it has reached Rs. 504.50 on 20.09.2017, 20 times in 52 months. We have covered this stock in our report on 13.05.2013.

If you practice above points for few weeks, you will be able to minimize your loss and maximize your profit easily.

In case you find this article useful, please share it with your friends for which we thank you.

Wish you a great success!

Wish you a great success!