Friday, December 29, 2023

Strategies for Employees to Achieve Financial Success and Wealth

Saturday, August 19, 2023

Investment planning for working people in India

* Plan Well Your Investment Journey *

It is easy to earn money in modern world. You just need a skill set and a start. After that your performance takes you higher in your career. Once you are in a job, it is your responsibility to manage your income smartly. It is seen that many youngsters start enjoying their life with their first job and spend a major part of their monthly income every month which is an unwise way to handle money. You must think about your like after your last salary.

Here are steps you must follow once you start earning.

1) Allocate Your monthly budget for general expenses, saving and investment in 3:1:1.

2) Treat your saving budget as loan account if your general expenses crosses the monthly budget in a month.

3) Open a #demat and #trading account and start investing in stock market based on fundamental research either by self or reading an equity report.

4) Make sure you do not exit unless you make a virtual loss in a stock at maximum 5%.

5) Try to hold a stock as long as it is to least 2% monthly growth. The longer you hold a stock, the bigger you make profit.

Having a focused interest in your financial progress, in few years only you can have a good amount of working capital, giving you regular small income. With passing time, your income from stock market will increase, if you manage your portfolio based on fundamental research.

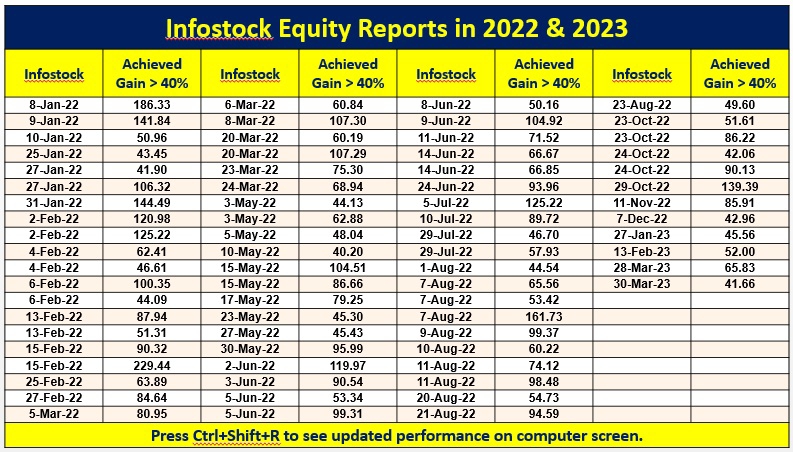

Infostock Equity Report is a fundamental research for Indian Investors. Here below is the performance sheet for your views.

Your comments are welcome. Browse our profile to benefit and share this post with friends if you like it.

Wish you great success in your financial life!

#investment #stockmarket #nse #financialsecurity #investmentplanning #infostockequityreport #infostockindia

Thursday, August 10, 2023

Saturday, July 22, 2023

Start Your Investment Journey

Search Infostock India on social media or google images.

Benefit from Infostock Podcast.

Share it with your friends and followers.

Make sure you focus on your Financial Security in life.

#financialsecurity

#fundamentalanalysis

#sharemarket

#indianinvestors

#demat

#portfolio

#investmentplanning

#infostockindia

#followus

#shareit

#subscribe

Tuesday, June 13, 2023

Thursday, May 18, 2023

Wednesday, September 28, 2022

Thursday, August 11, 2022

Tuesday, August 02, 2022

Wednesday, July 06, 2022

Sunday, May 22, 2022

Plan well to create wealth | Infostock India

Tuesday, March 22, 2022

How to start investing in stock market?

Stock Market Investment is a solo business of working people. It can create wealth in few years if your investment is based on fundamental research. We have made it simple for Indian Investors. With Infostock you get best investment opportunities in stock market at the ease and can take your a decision of buy, hold or sell at your own time and risk, keeping set exit price target in advance. Browse social media and check the performance of our past report for last few years and start investing to have a secure financial future.

Tuesday, March 15, 2022

Friday, March 11, 2022

Infostock Equity Report 10.03.2022 - Fundamental Analysis for Indian Investors

Today's Investment is Tomorrow's Financial Freedom

Share this post with followers and book your copy.

Register free on our website now.

#investment #stockmarket #financialplanning #stockstowatch #sharemarket #India #BestInvestmentStrategy #Howtoinvest #demataccount #InvestmentOpportunities #Howtomakeprofit #IndianInvestors #equityresearch #fundamentalanalysis #fundamentalresearch

Wednesday, February 23, 2022

Tuesday, February 08, 2022

Tuesday, November 23, 2021

Monday, August 30, 2021

Monday, July 26, 2021

Infostock Equity Report for Indian Investors

Infostock Equity Reports, No. 2 & 3, Investment Opportunities

Margin Money in the Indian Stock Market: Advantages, Risks, and Best Practices

Margin trading in the Indian stock market can be a powerful tool for investors looking to amplify their gains. However, it also comes with s...

-

Investment planning is crucial for financial stability and long-term wealth creation. In a country like India, with its ever-evolving econom...

-

Margin trading in the Indian stock market can be a powerful tool for investors looking to amplify their gains. However, it also comes with s...